Sustainability Insights to Drive 2025 Success

A review of 2024

"To effectively combat climate change, we need governments to enact smart policies and invest in innovation, finance to back green technologies and sustainable businesses, and consumers to demand and adopt climate-friendly solutions."

Source: "How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need", Bill Gates, 2021

2024 has been a year of immense change within Sustainability and Social Impact. Most notably, consistent market indicators now illustrate how the combination of economics with ethics is the most financially successful business model for leaders to implement.

In our recap of 2024, we’re going to dive into the ROI of Sustainability, the new Australian mandatory climate reporting requirements, the consolidation of Greenwashing regulations under ASIC and the ACCC, as well as the success of the inaugural Climate Action Week Sydney ‘24.

As we cast our mind back over the past 12 months, here are the major developments leaders need to be incorporating into their 2025 commercial strategies.

Sustainability Has Stepped Into The Core Operating Model

In 2024, organisations have faced six commercial pressures as they evaluate their exposure to the risks and opportunities presented by the decarbonisation of the Australian economy:

The need to Increase margins and market share in a more competitive, high-inflationary commercial landscape;

Navigating climate regulations as they impact entire supply chains;

Keeping pace with the expectations of Customers for more sustainable products/services;

Accelerating innovation while maintaining their employees’ post-COVID productivity levels;

Proactively handling supply chains shocks by evolving the risk management matrix to incorporate climate risks;

Banks, Investors and Insurers ‘greening’ portfolios by de-risking their exposure to climate-exposed organisations.

As a solution to each of these significant pressures, the incorporation of Sustainability into the business model makes commercial sense:

Credit: Zyad Hatquai

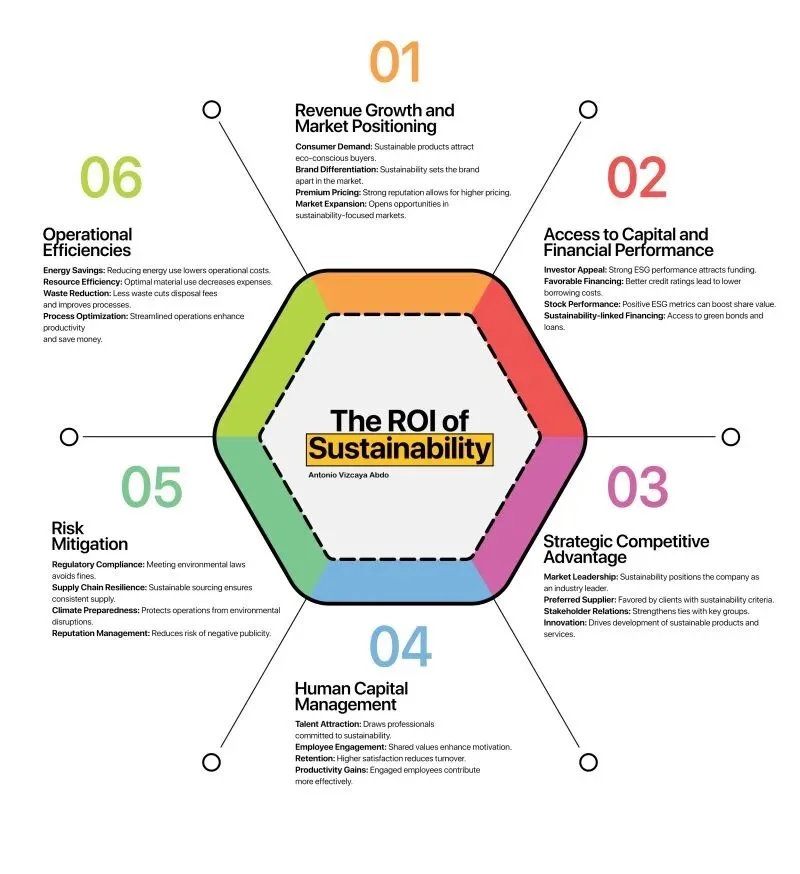

In fact, there are clear financial reasons Sustainability is quickly becoming the go-to strategy for leaders to deliver this market advantage via six key benefits.

Credit: Antonio Vizcaya Abdo

As climate risk is now recognised as financial risk, the days of an organisation being protected from any upstream or downstream adverse environmental or social impacts are dwindling. This is why Carbon Management platforms have become a key tool for the accurate tracking of Scope 1, Scope 2 and Scope 3 emissions, and to provide a strong foundation for the required baseline assessments.

As more industry leaders select impact and sustainability as the lens through which they can best deliver long-term value for their stakeholders, this emissions data has become critical when tendering, speaking with customers, investors, regulators, or applying for favourable interest terms via green loans.

Insurance companies are also taking their policyholders’ climate risk into greater consideration to determine insurance premiums and will continue requesting further emissions-related data to inform their decision making.

Australian Sustainability Reporting Standards (ASRS)

Which brings us to the big legislative climate news of 2024. Mandatory climate reporting was passed into law by the Australian Parliament on 9th September, bringing Australia in line with other major economies around the world. This has coincided with industry leaders doubling down on Sustainability as a core tenet of their operating model, creating competitive advantages against their peers in the process, and in response to the aforementioned investor demands.

From next month, organisations across the country will be operating in a new regulatory environment due to the national mandatory climate reporting coming into effect, just as customer expectations increasingly focus on which businesses they support

This legislation is already having a ripple effect along supply chains as the largest firms in the country begin assessing their value chain environmental footprint (Scope 3) and have commenced requesting emissions data from their current suppliers and companies wanting to submit new tenders.

Source: ASX

For some leaders, funding compliance is the priority, and my expectation is the implementation of these reporting standards will have a sizeable impact on each of the above reporting Groups. This is a result of the requirement to report to ASIC on climate from a whole-of-business perspective:

Governance (Board)

Strategy (Executives)

Risk Management and;

Metrics and Targets.

The Evolution of Sustainability

2024 has seen Sustainability evolve from CSR 2.0 into a direct reporting line to the Executive team and Board, specifically ongoing engagement with Audit & Risk committees on a regular basis. The personal liability of Boards of Directors in line with Chapter 2M of the Corporations Act has proven to be a noticeable motivator during these Governance transformations.

For organisations not already voluntarily reporting in the TCFD/ISSB format to date, this evolution of their Governance model is a significant body of work. From our experience working with Group 1 companies, this is a multi-year undertaking to achieve the required level of compliance. Leaning on the expertise of Known Impact or The Ocelli Group will make this a smoother endeavour for your organisation, as internal capacity and capability limits invariably lead to bottlenecks, indecision and delayed delivery, which is no longer an option with the mandated reporting dates.

What Does This Mean For Companies Yet To Start?

If this is your first time hearing about the Australian Sustainability Reporting Standards (ASRS), there are a number of things you can do immediately:

Understand the ASRS requirements

Assess your current state

Build a foundation for ASRS compliance

Focus on key challenges

Utilise available resources

For a Sustainability roadmap, below is a helpful guide for how your business can maximise your positive impact and begin reaping the commercial rewards of doing so.

You can then market the company’s initiatives with confidence that you’re not greenwashing, win tenders with customers by showing you can reduce their Scope 3 (supply chain) emissions, qualify for lower interest rates via green loans, increase employee engagement and productivity levels, and track the impact data of each initiative from the start:

Credit: Dr. Mohamed Tash

Greenwashing Has Become A Key Business Risk

Credit: Around Zero

Santos. GLAD. Vanguard. Active Super. Black Mountain Energy. Morningstar. MOO Premium Foods.

All experienced financial, legal and reputational damage as a result of successful Greenwashing investigations by ASIC and the ACCC.

Following ASIC’s dive into superannuation and investment funds, and the ACCC’s 2022 sweep of consumer brands within cosmetics, clothing and footwear, food and drink, and energy, it’s clear that greenwashing is a feature, not a bug, whether intentional or not.

In fact, the ACCC have stated that of the 247 businesses evaluated at random, 57% were committing greenwashing.

The ACCC has since published the Eight Principles For Trustworthy Environmental Claims for companies to abide by, and has warned they will take further enforcement action on those who continue to communicate to the market outside their guidelines. The easiest way to avoid the regulators attention is to follow the first Principle: “Make Accurate And Truthful Claims”.

As a result of following these guidelines, leading organisations have accelerated their commercial ROI in 2024 by speaking about their Sustainability and Social Impact initiatives, with the clear data to back it up.

Climate Action Week Sydney - CAW.SYD 2024

Climate Action Week Sydney (CAW.SYD) was created to put Sydney on the map as a global leader in climate action. There was a belief amongst the organising team that it was important to bring together the many groups committed to positive climate action, yet operating separately from each other.

The first Climate Action Week Sydney ran May 13th-18th, encompassing 115 community-organised events across seven key pillars:

Industry

Climate Tech

Investors

Government

Associations

Academia

Society

You can see the incredible results for yourself below:

You can also see more 2024 highlights here. Climate Action Week Sydney ‘25 is taking place March 10th-16th, and if you would like to host an event, volunteer or become a sponsor, you can find more information here.

What Does 2025 Hold?

Donald Rumsfeld’s infamous ‘unknown unknowns’ press conference has actually aged pretty well as a framework for Sustainability and Social Impact. In a world changing as fast as our present times, it’s important to run through this exercise as we head into the end of the year and your mind turns to 2025:

Known knowns: Things we know that we know. These are facts, certainties, and things we can confidently rely on.

Known unknowns: Things we know that we don't know. We are aware of our lack of knowledge in these areas, and we can actively seek to fill those gaps.

Unknown knowns: Things we don't know that we know. These are often subconscious biases, intuitions, or things we've learned but forgotten we know.

Unknown unknowns: Things we don't know that we don't know. These are the surprises, the unexpected events, and the things that can completely blindside us.

Once you have identified how you are positioned, Peta and the Known Impact team are a great place to start your Sustainability and Social impact journey, whether that is to be compliant with the ASRS, certify as a B Corp or quantify your impact through stronger governance and reporting.

For anything outside of this, The Ocelli Group is your one-stop-shop for all things Sustainability. We have a network of 45+ partners who can streamline your complicated Sustainability roadmap and have your 2025 Sustainability program up and running with minimal fuss.

Have a wonderful and safe holidays,

Dan Leverington